Did you know that there have been changes to the 1099 Forms starting in 2020? Fortunately, these are changes that shouldn’t be difficult to deal with.

Starting for the 2020 filing year, the IRS has introduced the 1099-NEC Form, which is to be used to report Non-Employee compensation, previously recorded on line 7 of the 1099-MISC Form. Currently, the definition of non-employee compensation refers to payments to individuals not on payroll, but rather on a contract basis to complete a project or assignment.

The 1099-MISC Form should still be used for rent payments, royalties, medical payments, gross proceeds paid to an attorney, etc.

While the 1099-NEC Forms can be downloaded for your reference, for 2020 the IRS requires either electronic submission via a third-party provider or physical paper copies to be mailed in. To file electronically, you are able to use a third-party app such as QuickBooks Online (QBO) which includes separate options for 1099-NEC and 1099-MISC filings. You will need to make sure to select the correct form to file for your specific vendors. Otherwise, physical copies of these forms can be ordered directly from the IRS

here.

The IRS has stated that the information provided on the 1099-NEC Form will not be shared with the state tax agencies. All 1099’s should also be submitted to the state services were performed in. California regulations have a deadline of February 28, 2021 for paper filing and March 31, 2021 for electronic submissions. If you are filing through QBO, forms will be electronically submitted to the IRS and state authorities.

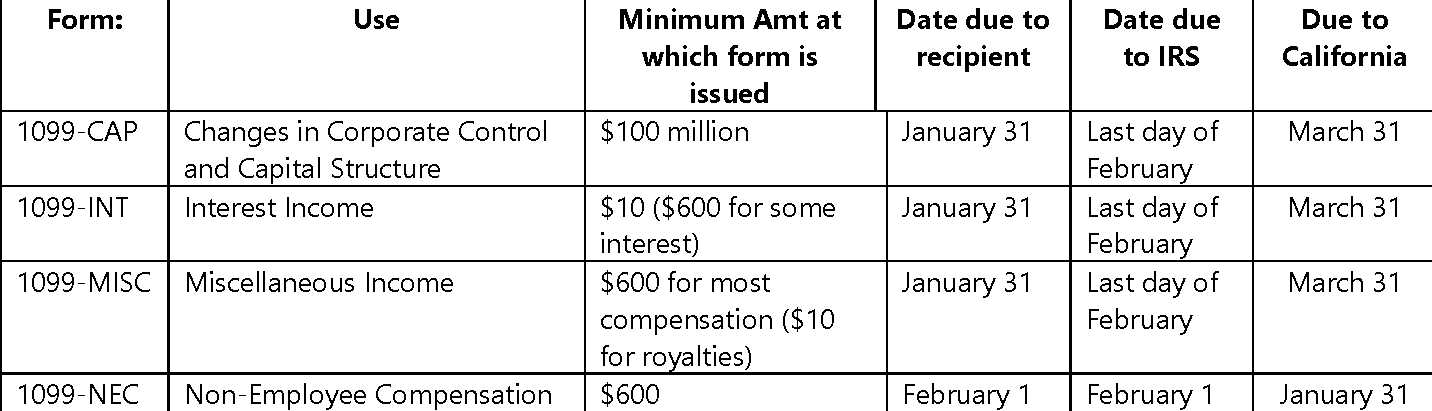

Some additional 1099s that you may need to file:

If the compensation you receive is reported on a 1099 Form, income taxes will not be deducted. Income taxes on this compensation can really add up, especially if your pay is high. If you fit into this category, you may want to look into making estimated tax payments during the year to avoid IRS penalties. Contact your tax advisor for help.

Under the tax law whether you receive a 1099 or not, if you have performed services that fit the requirements of 1099 filing, and were compensated for those services, you are responsible for reporting that compensation when you file your income taxes. Penalties can apply if you don’t.